Disclaimer: The Simple StartUp and it’s employees do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting professionals before engaging in any decisions about your business.

Now that we’re clear on the fact that I am not a certified accountant or officially licensed in any other way, except as a teacher and Personal Finance Education Instructor (yes that’s it’s own certification!), we can talk about taxes and your business. At the time I am writing this article, we are officially in tax season which starts on February 12th and runs to April 15th.

What is tax season?

Tax season is the window of time in which every person in the United States, who earned income during 2020, reports to the Internal Revenue Service (IRS) how much money they earned, how much they already paid in taxes, and other expenses that can be used to reduce the amount of tax owed. The IRS and your state take this information and determine how much tax you should have paid for the year 2020 to the federal government and the state. You will then either be issued a tax return if you overpaid your taxes or you will be told you still owe some taxes.

From a personal finance point of view, most people would much prefer to overpay their taxes and get a tax return as opposed to owing money, but in the Financial Independence community, the goal is to get as close to $0 owed or returned, since this means you are calculating your taxes correctly and able to put your money to work, rather than letting the IRS hold it for several months of the year without paying interest. If you are a beginner to paying taxes or learning about it, we are going to err on the side of over-paying (or over-saving) and getting a return, rather than owing money that we don’t have saved.

How does our tax system work?

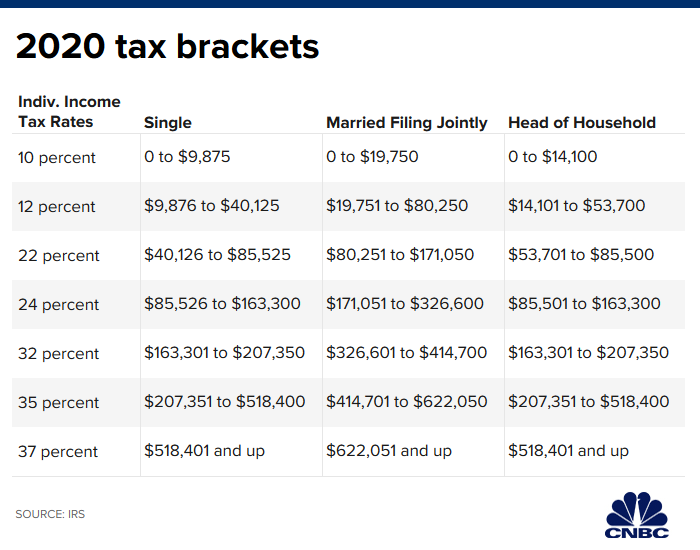

In the US, we operate what is called a “graduated tax” or “progressive tax” system. This means that as you earn more money, you will pay a higher percentage in taxes on those higher earnings. It’s a way of reducing the amount of tax paid by lower income households and getting more from high income households. Check out this video from Two Cents explaining how our bracket system works (note that the video is from 2018 so the numbers are not accurate for modern rates).

The most important thing to note if you are a dependent (still claimed on your parents taxes) is that you are encouraged to file your own tax return as soon as you have earned income (money made from your part time job or business) even though you are unlikely to owe taxes unless you made over $12,400. If you earned over $12,400 in 2020, you are required to file a tax return. It is your responsibility, not your parents, to make sure this is done, though you can get their help! (TurboTax)

Getting Started

The first step to figuring out your taxes is to make sure you have an accurate picture of your businesses finances. You should be tracking all income and all expenses using a Cashflow Statement. I wrote about how to track cashflow in a previous blog post.

You should know:

- How much money you made in each calendar year

- How much you spent on business expenses

- Your total profits

Unless you have set up a separate legal entity for your business (incorporation), your business earnings are treated the same as any income you earn from a job. This includes sole proprietorships, partnerships, and limited liability companies.

How much tax do I need to pay?

This unfortunately is not a simple answer. Our tax system is not straightforward and basic, but there are some rules you can follow to make sure you are on the side of getting a tax refund rather than owing.

Your first $12,400 of earned income is exempt from federal income tax, but not FICA taxes, which includes Social Security and Medicare (see video to explain these in more detail). Your state also has its own rules and every state is different, so you will need to look up your state’s income tax rules on your own or ask your accountant.

The “effective tax” rate is what percentage of your overall income is paid in taxes after you account for all the deductions and marginal tax brackets. In the US, the average effective tax rate is 27.1%. This is a great number to use when estimating your own taxes and one that I use myself. If you are making side hustle or business income, putting 30% of all your profits into a separate dedicated savings account to set aside for taxes owed, is a great way to ensure that you are going to have enough money to pay any taxes owed. Since you are not paying taxes on your money earned throughout the year, it is important that you are setting aside the money you potentially owe in taxes. You are treating it like you are paying taxes, but you are holding the money yourself and not touching it until the IRS lets you know how much you owe in taxes. Once you have that number, you can take it from your tax account and the remainder is your “tax return” for the year. Your tax money should be in a high-yield savings account, such as at CIT bank, where it can earn a tiny amount of interest, but it is not invested with a risk of loss.

Estimated Taxes

Once your business grows to a certain point of owing over $1000 in taxes your accountant may say you need to start paying taxes 4 times a year. You will pay “quarterly estimate” which is a guess of how much tax you owe every 3 months based on how much you earned in the previous year.

Your accountant can guide you as to how much to pay and where to pay it to.

Reducing Taxes Owed

I will have a separate blog post on this, but there are steps you can take to reduce the amount of tax that your business owes. Things like business expenses, charitable donations, and contributions to pre-tax retirement accounts can all reduce the amount of income that the government can tax, which will decrease the total amount of tax owed by you.

If you are earning income and haven’t started an IRA yet to save for the future, I highly recommend you start one today! If you are a minor and working a minimum wage job and maybe a small amount of income coming from your business, I recommend starting a Roth IRA and putting as much of your income in there as possible. Here’s a quick explanation of IRA’s in case you need it.

As I said at the beginning, I am not a tax professional and this is for informational purposes only. Putting aside money in a dedicated tax savings account is how I handle all extra income from my side hustles. With my employer, I also ask them to take out more taxes on my W-4 form. This is a way to get your taxes paid in advance through your employer and reduce the amount “owed” at tax time. I will typically have a very sizable tax “return” in April based on money given back to me from the IRS or having a significant amount more saved in my tax account than I actually owe the IRS.

Do you have a different strategy for handling your taxes or ways that I could improve my method? If so, share it in the comments or send me an email!

Additional Resource: